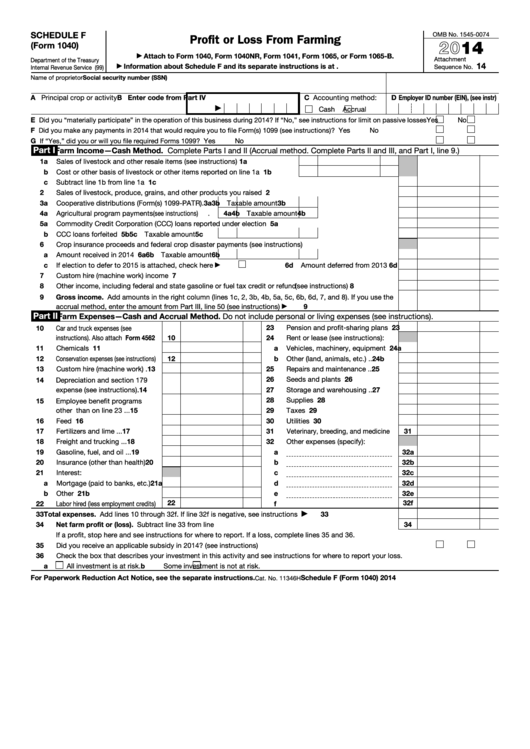

Sales of livestock, produce, grains, and other products (see instructions)Ĭooperative distributions (Form(s) 1099-PATR)Ĭommodity Credit Corporation (CCC) loans:ĬCC loans reported under election. Complete Parts II and III, and Part I, line 9.)įor Paperwork Reduction Act Notice, see the separate instructions.įarm Income-Accrual Method (see instructions) If a loss, complete line 36.Ĭheck the box that describes your investment in this activity and see instructions for where to report your loss:įarm Income-Cash Method. If a profit, stop here and see instructions for where to report. If line 32f is negative, see instructions. Do not include personal or living expenses.

If you use theĪccrual method, enter the amount from Part III, line 50. Add amounts in the right column (lines 1c, 2, 3b, 4b, 5a, 5c, 6b, 6d, 7, and 8). Other income, including federal and state gasoline or fuel tax credit or refund (see instructions). If election to defer to 2022 is attached, check here. Ĭrop insurance proceeds and federal crop disaster payments (see instructions): Ĭommodity Credit Corporation (CCC) loans reported under election.

Īgricultural program payments (see instructions). Sales of livestock, produce, grains, and other products you raisedĬooperative distributions (Form(s) 1099-PATR). Sales of purchased livestock and other resale items (see instructions)Ĭost or other basis of purchased livestock or other items reported on line 1a G If “Yes,” did you or will you file required Form(s) 1099?. ▶ Go to for instructions and the latest information.Į Did you “materially participate” in the operation of this business during 2021? If “No,” see instructions for limit on passive lossesį Did you make any payments in 2021 that would require you to file Form(s) 1099? See instructions

0 kommentar(er)

0 kommentar(er)